Iran Automotive Industry Outlook

View online report

Automotie Industry Iran – Past to Present

The benefits of developing a domestic automotive industry are significant. The worldwide automotive industry is estimated to have a total cash flow of more than 2,790 billion USD with a total production capacity of approximately 90 million (PV* and CV**) and it employs more than 48 million people (directly and indirectly). Accumulated this would make up for the 7th biggest economy of the world.

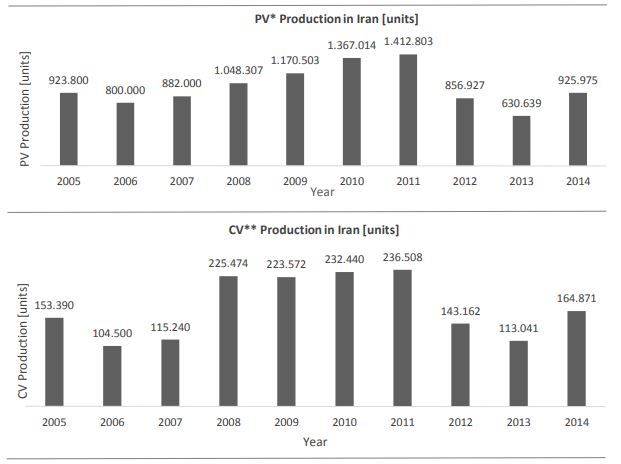

The first Ford Model T’s arrived in Iran in the 1930s and by 1955 annual imports had soared to approximately 10,000 units. Nowadays the domestic Iranian automotive industry is estimated to have a yearly nominal production capacity of 2 million cars (PV and PC combined) of which around 1.09 million units of PV and CV production capacity is being utilized. It employs more than 1.5 million people (directly and indirectly) making up for 12% of the countries workforce. Furthermore it has a daily nominal production capacity of 10 million components whilst drawing input from sixty related industrial fields.

With total sales of 12 billion USD it makes up for approximately 19% of the total industry, as well as for approximately 2.5% – 3% of Iran’s GDP. Furthermore it is responsible for 14% added value creation contribution to the whole industry. The average profit of the industry is 4.5%. The Iranian automobile industry makes up for 1.2% of world production, and currently holds rank 18 to 20.

Iran Domestic Automotive History

- 1969 : Starting the production of Citroën Dyane models

- 1976- 1980 : Starting the production of Renault models

- 1993 : Starting the production of KIA Pride model

- 1995- 2001 : Peugeot Samand pilot productio of Xantia

- 1967 : Establishment of the stock company Citroën Iran

Major Players

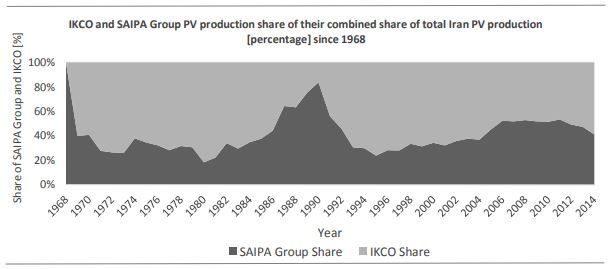

Several national brands exist, such as IKCO, SAIPA, Pars Khodro, Kerman Khodro, and Bahman that produce a variety of different models (such as Samand, Tiba, Dena, etc.). IKCO and SAIPA are the biggest automotivemanufacturers and together own more than 79% of the total market share.

For more information: Download Report

Iranian automobile companies

major players

- iran khodro companz

- pars khodro

- renault pars

- volkswagen group

- saipa corporation

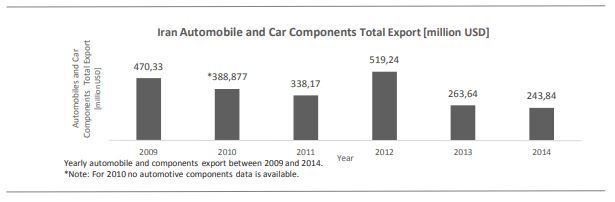

Automobile and Car Components Export

Iran also looks at its automotive industry as an important sector for exporting its products to neighboring countries. In 2012 Iran exported 520 million USD worth of automobiles and car components. The situation for car and component manufacturers worsened in the following years, leading to a diminishing export value by 2013 to 263 million USD. In 2014 Iran’s share of exporting automobiles and car components was announced to be at 243 million USD. There are several reasons for the drop, however, experts concur that the key reasons are low quality and at the same time a high price.

The current situation and development of iran automative industry

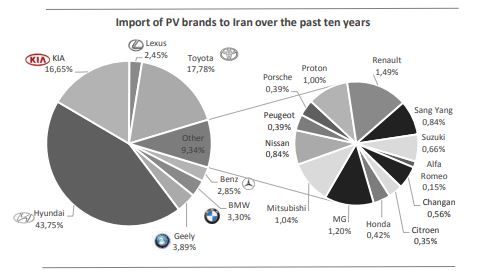

Currently the Iranian automobile import market is ranked on 75th place worldwide, making up for less than a percent of the global automobile and component importing market share. In 2010, its market share was 0.2 percent with a total value of 2.5 billion USD. During 2011 the market share did not change, however, the total value of it increased to 2.9 billion USD.

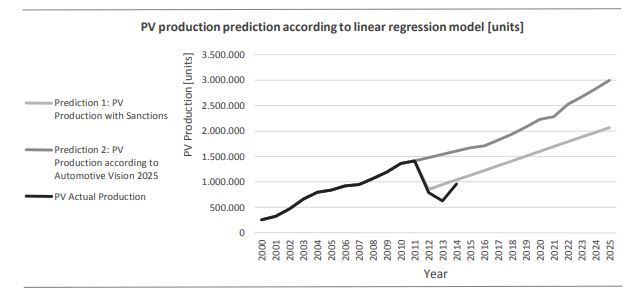

Economic sanctions were a big setback for Iran’s automotive industry, especially at a time when the industry was ready for major expansion.

Since the year 2012 the production output decreased by approximately 50% (from 1.4 million to 0.7 million), whilst at the same time the price of cars increased radically by about 300%. Furthermore the quality of Iranian-made cars dropped at a similarrate as well.

For more information: Download Report

will foreign investment to realize iran’s automative industry

Foreign automakers have long understood the potential of Iran’s large domestic market and the combination of low labor costs and local parts production. Iran’s industrial workforce is skilled and experience, particularly relative to their compensation. The monthly minimum wage is IRR 18.34 million for the current Iranian calendar year—now equivalent to less than USD 100 per month at current exchange rates. Between 2009 and 2011, two out of every 100 cars and commercial vehicles produced worldwide was manufactured in Iran. Allowing foreign firms to be the majority shareholders of their joint ventures was an important shift in industrial policy for the “strategic” automotive sector. Such policy was also intended to address the long-running issue of inefficiency and poor productivity among the state-owned automakers.

Sanction Situation and Impacts

Over the past years sanctions have had a serious effect on Iran’s economy and its people. Since 1979 the United States has led international efforts to utilize sanctions in order to influence Iran’s policies, including Iran’s uranium enrichment program which Western governments fear is intended for developing the capability to produce nuclear weapons.

- EU Sanctions Started since 2007 intensified since 2008

- US Sanctions Started since 1997 Intensified since 2007

- UN Sanctions Started since 2006 Intensified since 2008

Sanction Impacts

Despite the fact that Iran’s economy has been suffering from the effects of intensified international sanctions since 2007, different industrial sectors have shown deviating levels of instability. Since 2010, the Iranian total passenger car production dropped considerably, as a direct effect of the sanctions impact on the automotive sector.

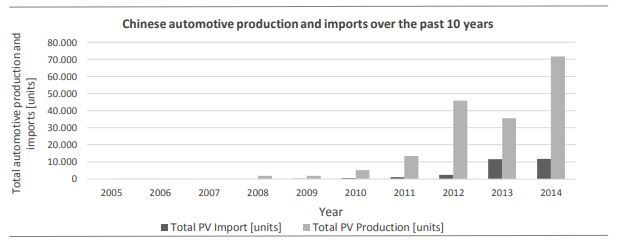

Chinese Competition

Chinese automotive companies have gained a wide presence in the Iranian automotive market since 2010 by taking advantage of the sanction situation, mostly through cooperation’s with domestic automakers (mainly the private ones).

One of the major players Chinese in Iran was Chery, however, ever since many other brands have entered adding up to a total of ten today. Those ten Chinese automakers have so far launched 30 different models in a variety of price ranges.

Future of the Iranian Automotive Industry

Obtaining the first rank in the region’s automobile industry, the fifth rank in Asia and the eleventh rank in the world, focusing on competitive landscape development based on technological advancement. Some of the most significant shortcomings of the Iranian automotive industry include insufficient financial access, poor financial statements in general, and low product quality for a high price

The Iranian Ministry of Industry has developed a strategic plan for the automotive sector consisting of nine key strategies in order to reach the aforementioned target. The nine key strategies and some main action plans are:

- increase manufacturing power

- investment development

- increase technology penetration

- development of inter-business collaboration

- expand international collaborations

- diversification in finance methods

- managing import value of cars and parts

- supporting domestic brand consumers

Latest Development to encourage engine manufacturers in iranian automobile industry

- In 2020, the passenger cars production in Iran registered 826,210 units, with a rise of 7% compared to the previous year. Full-year sales for passenger cars in 2020 have been recorded at 816,497 units, reporting an 8.7% increase in sales compared to 2019.

- In January 2021, Iran’s largest automotive firm, the Iran Khodro Company (IKCO), unveiled a domestically-made three-cylinder engine EC5.

- Shahrivar 1390: Mr. Moghimi (CEO of Iran Khodro) announced on the sidelines of the ceremony to start the production of Dena Plus with the new MT6 gearbox on 29th of Shahrivar regarding the construction and production of Iran Khodro’s new gearboxes, that the semi-automatic gearbox (AMT) will be produced in the fall of 2021 in Qazvin company. The engine is produced. It starts and according to the plan, Rana Plus will be produced as the first product of Iran Khodro with this new gearbox in March 2019, which can be mentioned as a recent development.

- Among other recent developments, we can refer to June 1400, when the research phase for the construction of the DCT7 gearbox has started. Mr. Zulqader (Deputy Executive Officer of Niro Motive Company) announced that the research project for the construction of Iran Khodro’s 7-gear double clutch gearbox, which started in 2019, is still ongoing

For more information: Download Report

Table of Contents

View Online Report

Table of Contents

Authors

Marlon Jünemann

Founding Partner

juenemann@ilia-corporation.com

Amir Ebrahimzadeh

Principal

ebrahimzadeh@ilia-corporation.com

Hoda Hosseinifar

Principal

hosseinifar@ilia-corporation.com

Frequently Asked Question

ILIA Corporation is a boutique management consultancy firm,focused solely on helping local and international organisations operate in Iran.ILIA empowers clients through every stage of the market entry process, from in-depth Market Insights,through to comprehensive Implementation Solutions and ultimately support during the Execution Process.Operating in Iran for nearly a decade, serving Fortune 500 companies, SME and government institutions alike, we provide clients an experienced consulting team and leverage an unrivalled network of local experts, to help you unlock the full potential of the Iranian market