Pharmaceutical Industry -World

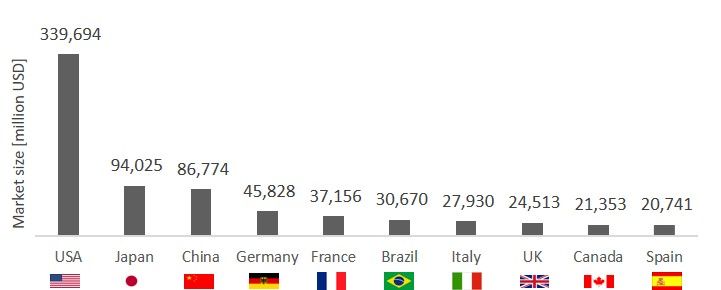

The pharmaceutical industry is the 2nd most profitable in the world after the oil, gas and petrochemicals industry. It is considered a high-tech industry, heavily regulated and with large investments going towards R&D activities. Being a high-tech sector with by far the highest added value per person, the pharmaceutical industry is the greatest manufacturing industry. The pharmaceutical industry is also the sector with the highest ratio of R&D investment to net sales, with a total expenditure of 141.6 billion USD in R&D per year. Over 4.44 million people work in this industry with 91.3 billion USD in salaries in 2013. Total investment of global pharmaceutical was 70.7 billion USD in 2014 that decreased 1.4 compared in 2013. ten top markets of worldwide pharmaceutical in 2013 is show in blow figures. The main point is presence of new competitors from emerging economics such as China, Brazil, and India.

Pharmaceutical Industry – Iran

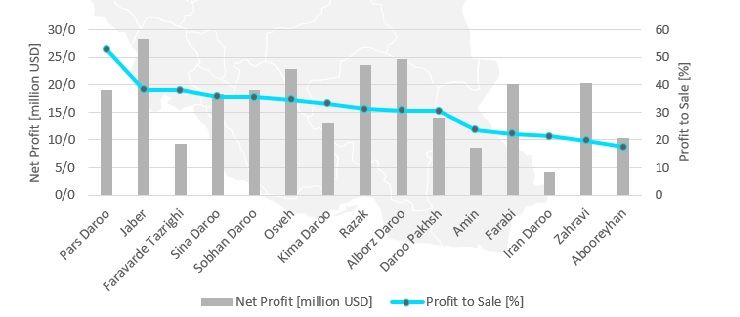

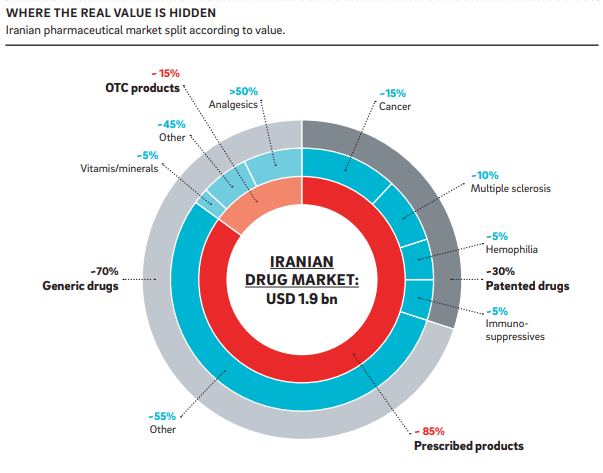

In 2014 the Iranian pharmaceutical market was estimated at 2.35 billion USD and it is predicted to be at 3.31 billion USD in 2019, with a CAGR of 7.5 percent. In term of medicine and medicaments, there are about 56 pharmaceutical companies in Iran, of which 36 are stock listed companies that are producing more than 90% of the products. Furthermore, there are 123 registered importers, 30 specialized distribution companies and 10,000 drugstores. There are many successful stock listed companies in Iran which are profitable. In the following diagram net profit and also profit ratio to sale amount, is presented. Average ratio of benefit to sale of pharmaceutical companies in 2014 was approximately 31 percent. The highest ratio is for Pars Daroo with 52.8 percent and the lowest for Abooreyhan with 17.4 percent.

Iran Political Power Structure

The Iranian power structure consists of parallel Islamic and democratic institutions with a lot of checks and balances. Most strategic decisions are made in councils where all factions exert influence. There is an ongoing bargaining process between networks of power.

Dynamics of Voter Turnout

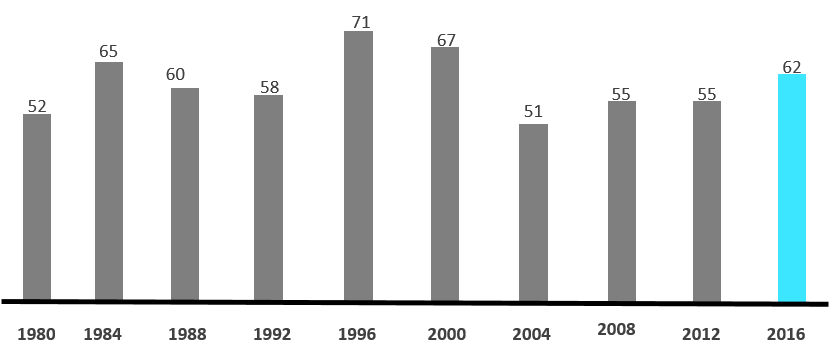

- In the past 3 Majles elections before 2016, voter turnout has been below overall average.

- The Iranian society was relatively enthusiastic about these elections and voter turnout was about 62%;

- Analysts agree that voter turnouts above 55% give an edge to the more moderate political forces.

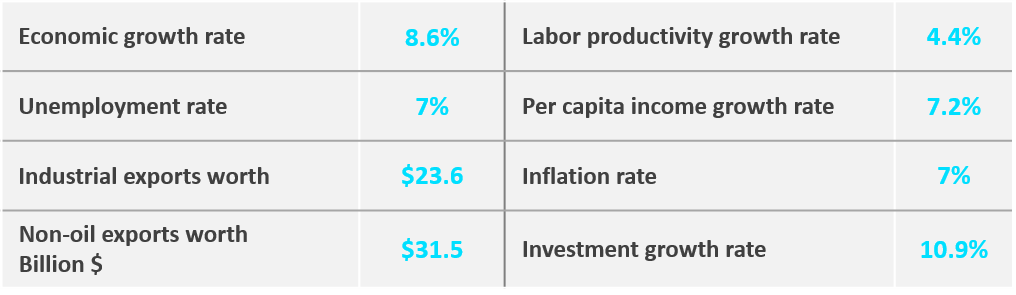

Direction of Government (Strategy 2025)

Iran is a developed country, on first place in the region in the realms of economy, knowledge and technology; with an Islamic and revolutionary identity, an inspiration for the world and with productive and influential interactions in International relations.

Established pharmaceutical infrastructure

Sanctions have forced Iran to build a substantial, largely self-sufficient drug production infrastructure. Some 60 plants produce almost 40 billion drug units each year, meeting 96% of domestic demand. Most do not meet international good manufacturing practice standards, but government initiatives are addressing this. Research and development focuses mainly on new generic drugs, although investment in novel products is increasing: 12 new treatments for diseases including cancer and diabetes were launched in 2015

Skilled workforce

Some 80% of Iranians receive a secondary education, and the literacy rate is more than 98%, according to the UN. When it comes to science and medicine, its high standards of education appear to be paying off.

In 2012, the science database Scopus ranked Iran 17th in the world in terms of output of scientific papers, and it was 23rd in terms of highly cited medical articles in 2011.

Competitive landscape

Iran has a lively pharmaceuticals market. The sector is made up of about 100 companies, B with most focused on drug manufacturing. Some also carry out R&D, import non-locally produced drugs or provide distribution, offering ample potential for cooperation.The largest producer is Darou Pakhsh Pharmaceutical Manufacturing, which also distributes drugs through its Darou Pakhsh Distribution subsidiary. The company generated revenues of over USD 700 million

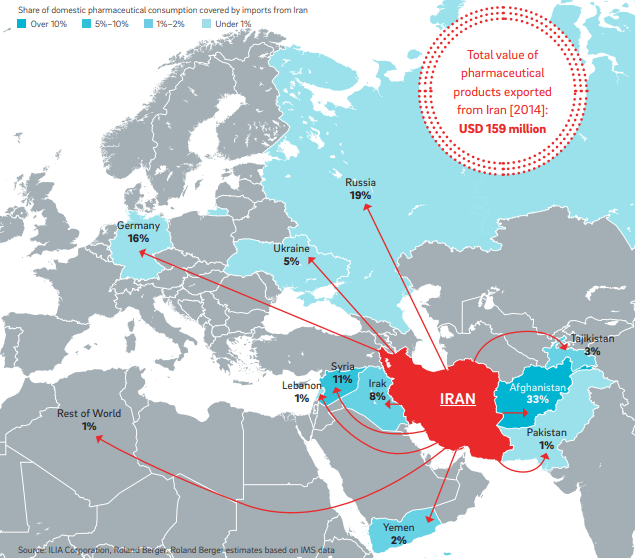

A trade opportunities crossroad in the pharmaceutical industry

From the ancient Silk Road to China’s new One Belt, One Road project, Iran has always enjoyed a prime position on international trade routes. Its geographic location also makes it an ideal export hub for Central Asia (especially Afghanistan, Russia, Syria, Iraq), a position enhanced by special economic zones and ready access to its 15 neighbours (population: 400 million) through trade agreements. C Iran’s biotech and drug-making expertise has seen it win several large export deals.

Iran Pharmaceuticals & Healthcare Report

The Iran Pharmaceuticals & Healthcare Report features Fitch Solutions’ forecasts for drugs and healthcare expenditure and imports and exports, focusing on the growth outlook for the prescription, OTC, patented drugs and generics market segments.

Current situation of the Iran’s pharmaceutical market

Government of Iran has invested considerably on the pharmaceutical industry over the past decades. However, it seems that this investment, mainly due to the lack of R&D activities and unanimous subsidies, has not been proportionately fruitful for Iran’s health system. Iran drug market, especially in recent years, experienced a sharp growth and in 2004 the value of the market, including direct government subsidies to the imported medicines, became over USD1.2bn. The market has increased annually, on average more than 30% , during 1993-2003.

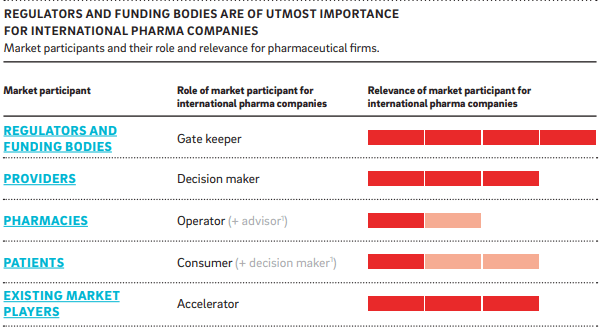

Consider the regulatory framework

Approval process: FDA authorization is a prerequisite for the sale of drugs in Iran, whether the product is imported or produced locally. The application process to introduce new drugs is not dissimilar to those in developed markets, but may be less transparent and more time consuming. The first step involves registering the product by submitting drug data, import-export and authorization documents. Once certified by an Iranian consulate, these documents are passed to legal commissions for consideration. If successful, the drug is added to the IDL. The process usually takes about a year. If approval is being sought for a drug already listed on the IDL, the imported version need only be approved by an FDA-accredited laboratory.

Establish back-end processes and route to market

The setting up of backend functions, such as sourcing and manufacturing, will vary depending on the choice of local production or import. But in both cases the route to market is identical. Sourcing: Half of the raw material used in drug manufacturing in Iran is imported. But local sourcing is on the rise, and a number of base materials required to make rare medicines have reportedly been produced since 2013.

Manufacturing: The government is planning to expand Iran’s already considerable drug-making capacity. It wants to build on its mostly generics-producing base by branching out into the manufacture of patented medicines as part of its post-sanctions strategy. But whether carried out at self-owned facilities or those of partners, manufacturing in Iran must abide by certain cultural rules. Selected medicines and dosage advice must be halal compliant, for example, and patient information must be provided in English and Farsi.

Top pharmaceutical companies in Iran

- Exir Pharmaceutical. …

- Ferring. …

- GlaxoSmithKline. …

- Novartis. …

- Raha Pharmaceutical Company. …

- Roche. …

- Shafa Pharmaceutical and Hygienic Co. …

- Tasnim Pharma.

Address promising market segments

As health awareness rises in the country, the market for vitamin and dietary supplements is expected to become another important area according to Euromonitor. In the prescription sector, there are several supply gaps owing to the fact that many prescribed drugs cannot be produced locally. The largest are for oncology, multiple sclerosis and insulin drugs. An expected epidemiological shift towards chronic diseases is likely to crank up this demand further.

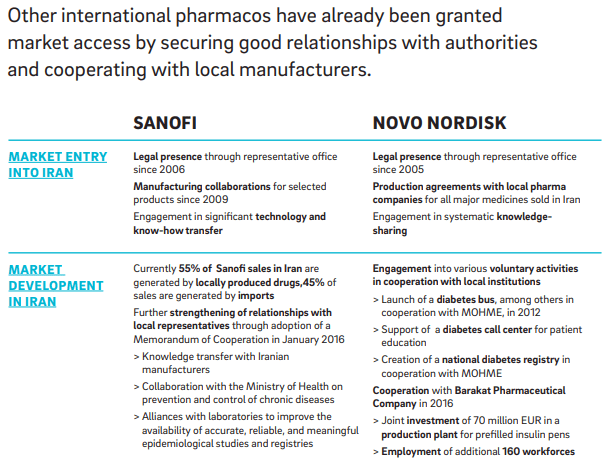

Establish domestic partnerships

Collaboration with local players is the dominant strategy employed by international companies wanting to establish a foothold and grow in the Iranian pharma market. As mentioned, such partnerships offer new entrants access to infrastructure, distribution networks and key stakeholders. Large Western pharma companies such as Pfizer, Merck, Novartis, Roche, Boehringer Ingelheim and Sanofi have all already employed this tactic. Several multinationals, for example, have partnered with Tehran-based Modava Pharmaceutical Company to facilitate distribution through its affiliate Shafayab Distribution. Novartis also sources secondary packaging from Modava, and is instituting API production, too.